Recent Newsletter Articles

-

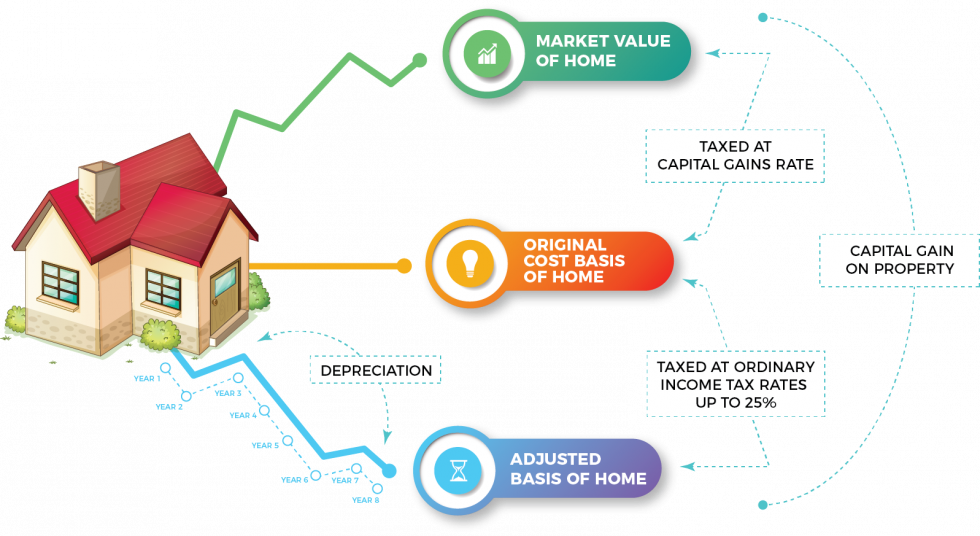

#87 Depreciation Recapture

—

by

If you spend enough time around real estate investors and ask enough questions, eventually the topic of depreciation recapture emerges. This is a subject you need to understand if you want to avoid an unpleasant surprise when your deal closes and the tax bill arrives. As you likely know, one of the significant advantages of…

-

#86 Book Review: The Science of Scaling

—

by

The Science of Scaling by Benjamin Hardy and Blake Erickson offers a compelling framework for entrepreneurs who want to scale their businesses but struggle to identify the path forward. While written primarily for business owners, the core principles apply to building an investment portfolio capable of generating the passive income needed to break paycheck dependency.…

-

#85 The Differences Between Saving, Investing, and Speculating

—

by

People often use the terms saving and investing interchangeably. This creates real problems. When you treat fundamentally different concepts as the same thing, you make decisions based on faulty assumptions about risk, return, and control. Understanding the distinctions between saving, investing, and speculating is not academic. It is the foundation for building a portfolio that…

-

#84 Successful Investors Know What They Are Looking For

—

by

Through consulting calls and networking conversations with newer investors, one pattern emerges consistently. Many investors lack clarity about what they are looking for in a deal. Some pursue impossible deals: 30% IRR, 10% cash-on-cash returns, complete liquidity, and zero risk. These opportunities do not exist. If they did, institutional investors would jump on them before…

-

#83 Reflections on 2025 and Looking Ahead to 2026

—

by

As 2025 draws to a close, I reflect on a year defined by meaningful connections and growth. While it may be cliché to acknowledge, the most valuable moments this year emerged from relationships, including my ongoing conversations with many of you. Highlights Several highlights stand out as I look back on 2025. I began publishing…

-

#82 What Are Your Plans for 2026?

—

by

As the year draws to a close, this is the natural moment to pause. To reflect on what you have accomplished over the past twelve months. To consider what you want to create in the year ahead. Before you rush into setting New Year’s, I suggest you first consider the question: What would you do…

-

#81 Book Review: The Gap and The Gain

—

by

I just finished re-reading The Gap and The Gain by Ben Hardy and Dan Sullivan [1] for the Money Mental Book Club. One member captured the book’s essence perfectly: you could summarize its core message in a LinkedIn post, but you need to read it multiple times to truly internalize its principles. The short summary…

-

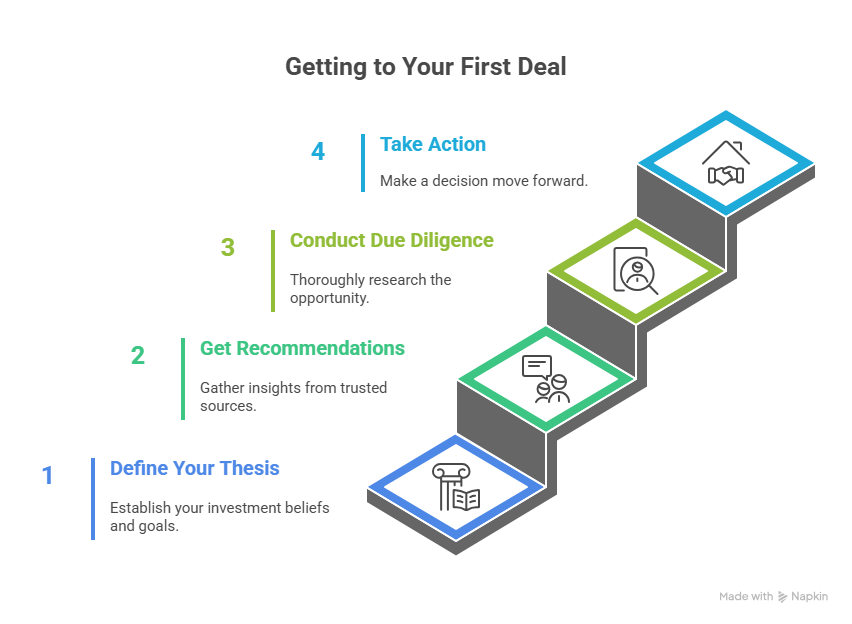

#80 Taking Your First Step: A Practical Framework for New Syndication Investors

—

by

Last week I was talking to someone who is struggling to get started in syndications. Conceptually, they understand the attraction of getting cash flow from an investment while that investment continues to appreciate in value. But they are having a hard time making a decision on what to invest in. They asked the question: “If…

-

#79 Break Your Paycheck Dependency

—

by

This week, Amazon announced layoffs affecting 14,000 employees. These are not underperformers or redundant workers. They are people who show up every day, contribute meaningfully to the company mission, and believed their positions were secure. Having spent over a decade at Amazon myself, I understand the shock and uncertainty these individuals now face. But this…