Newsletter Archive

I am a lifelong learner, and have been studying REI for 30+ years. Our newsletter is my attempt to summarize key information in a way that allows you to learn the lessons faster than I did.

I cover a lot of topics including: book reviews, current events, basic principles, opportunities I am looking at, and deep dives into syndication concepts.

I hope you find this information educational and insightful – and most importantly worth the time that you are investing

Disclaimer: I am not a lawyer or CPA. This is not legal, financial, or tax advice or a solicitation to participate in a deal. It is just my thoughts on what I perceive as an incredibly powerful approach to investing.

Subscribe to our Newsletter

We publish an article related to Real Estate Investing approximately fortnightly (every two weeks).

By subscribing you will have the full article sent directly to your email.

We use Amazon AI to read the articles we post and make them available for those who prefer to listen to their content.

-

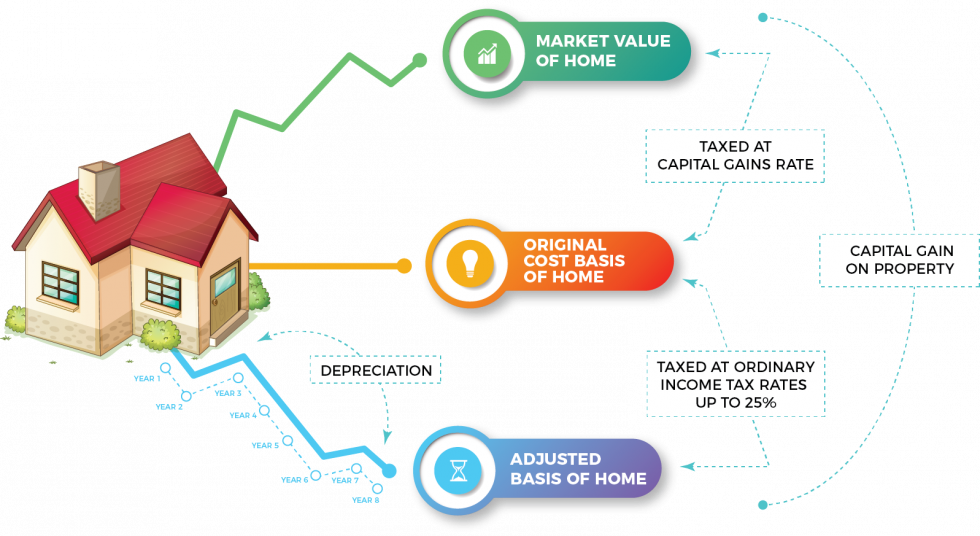

#87 Depreciation Recapture

—

by

If you spend enough time around real estate investors and ask enough questions, eventually the topic of depreciation recapture emerges. This is a subject you need to understand if you want to avoid an unpleasant surprise when your deal closes and the tax bill arrives. As you likely know, one of the significant advantages of…

-

#86 Book Review: The Science of Scaling

—

by

The Science of Scaling by Benjamin Hardy and Blake Erickson offers a compelling framework for entrepreneurs who want to scale their businesses but struggle to identify the path forward. While written primarily for business owners, the core principles apply to building an investment portfolio capable of generating the passive income needed to break paycheck dependency.…

-

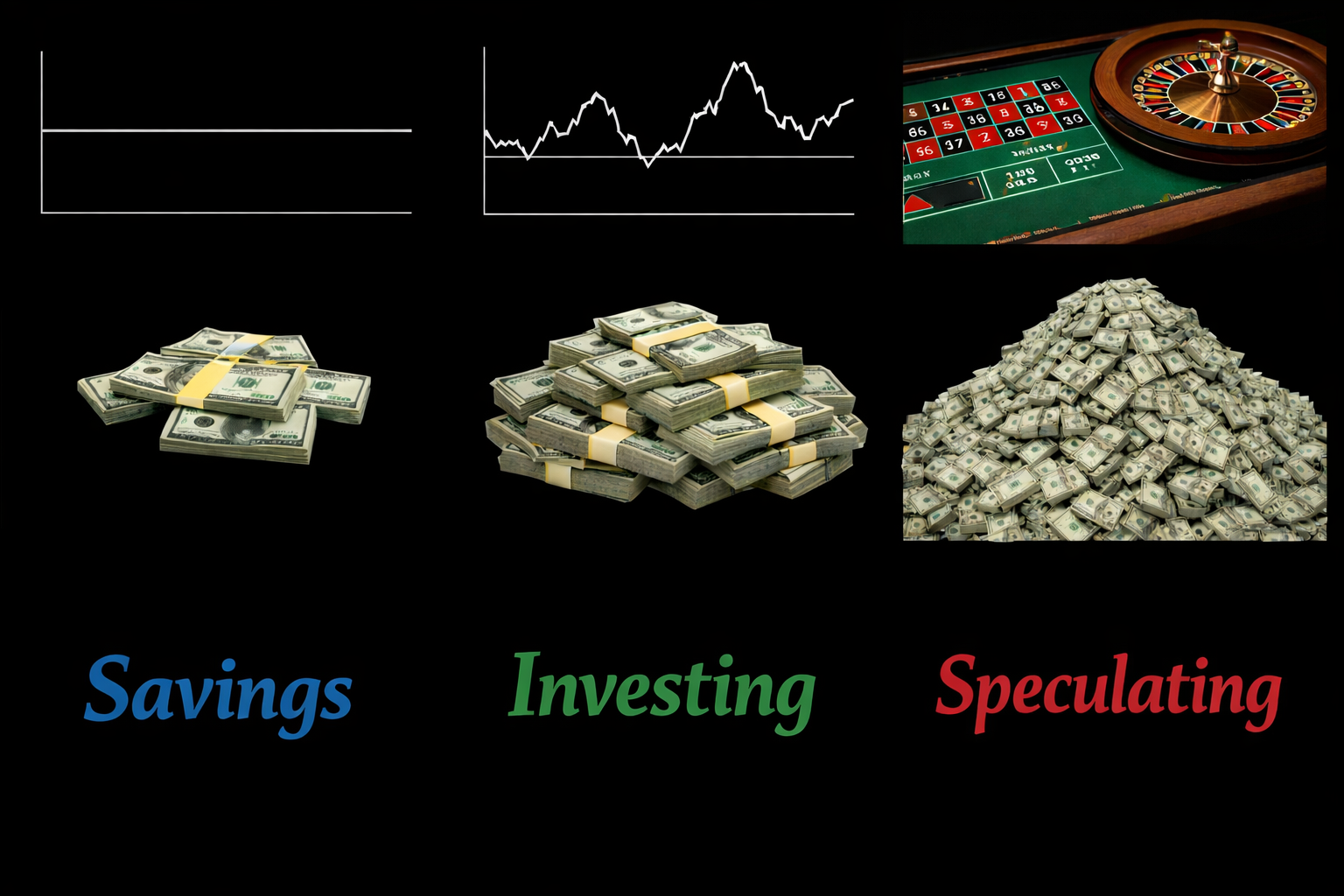

#85 The Differences Between Saving, Investing, and Speculating

—

by

People often use the terms saving and investing interchangeably. This creates real problems. When you treat fundamentally different concepts as the same thing, you make decisions based on faulty assumptions about risk, return, and control. Understanding the distinctions between saving, investing, and speculating is not academic. It is the foundation for building a portfolio that…

-

#84 Successful Investors Know What They Are Looking For

—

by

Through consulting calls and networking conversations with newer investors, one pattern emerges consistently. Many investors lack clarity about what they are looking for in a deal. Some pursue impossible deals: 30% IRR, 10% cash-on-cash returns, complete liquidity, and zero risk. These opportunities do not exist. If they did, institutional investors would jump on them before…

-

#83 Reflections on 2025 and Looking Ahead to 2026

—

by

As 2025 draws to a close, I reflect on a year defined by meaningful connections and growth. While it may be cliché to acknowledge, the most valuable moments this year emerged from relationships, including my ongoing conversations with many of you. Highlights Several highlights stand out as I look back on 2025. I began publishing…

-

#82 What Are Your Plans for 2026?

—

by

As the year draws to a close, this is the natural moment to pause. To reflect on what you have accomplished over the past twelve months. To consider what you want to create in the year ahead. Before you rush into setting New Year’s, I suggest you first consider the question: What would you do…

-

#81 Book Review: The Gap and The Gain

—

by

I just finished re-reading The Gap and The Gain by Ben Hardy and Dan Sullivan [1] for the Money Mental Book Club. One member captured the book’s essence perfectly: you could summarize its core message in a LinkedIn post, but you need to read it multiple times to truly internalize its principles. The short summary…

-

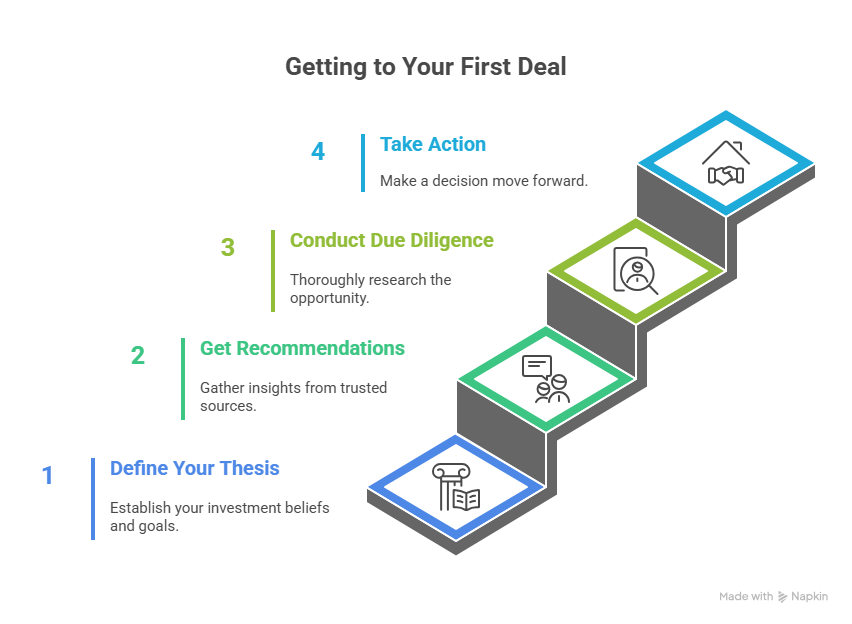

#80 Taking Your First Step: A Practical Framework for New Syndication Investors

—

by

Last week I was talking to someone who is struggling to get started in syndications. Conceptually, they understand the attraction of getting cash flow from an investment while that investment continues to appreciate in value. But they are having a hard time making a decision on what to invest in. They asked the question: “If…

-

#79 Break Your Paycheck Dependency

—

by

This week, Amazon announced layoffs affecting 14,000 employees. These are not underperformers or redundant workers. They are people who show up every day, contribute meaningfully to the company mission, and believed their positions were secure. Having spent over a decade at Amazon myself, I understand the shock and uncertainty these individuals now face. But this…

-

#78 Why I Believe In Syndications

—

by

As most of you know by now, I am a strong advocate for investing in syndications. After 30 years of studying real estate investing and transitioning from active property ownership to passive investing, I credit my syndication investments with allowing me to retire just six years after I began investing in them. However, you may…

-

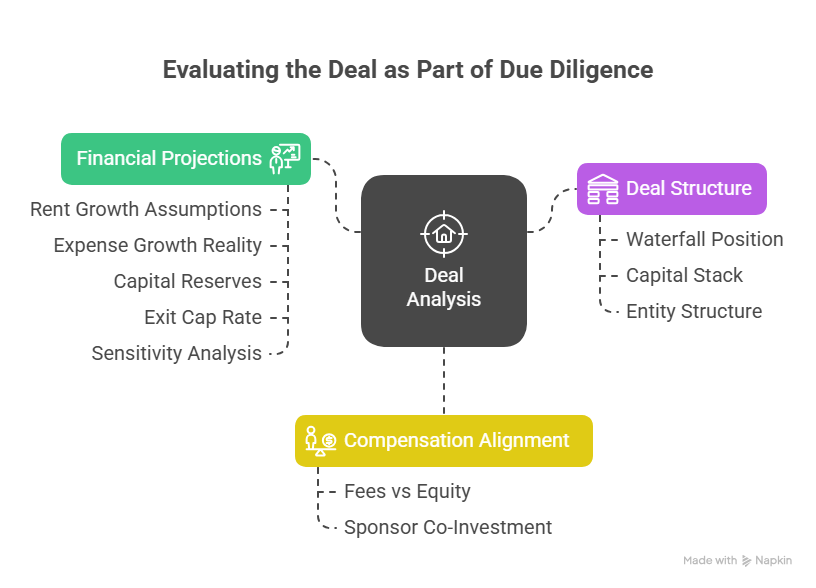

#77 Due Diligence: Evaluating the Deal Itself

—

by

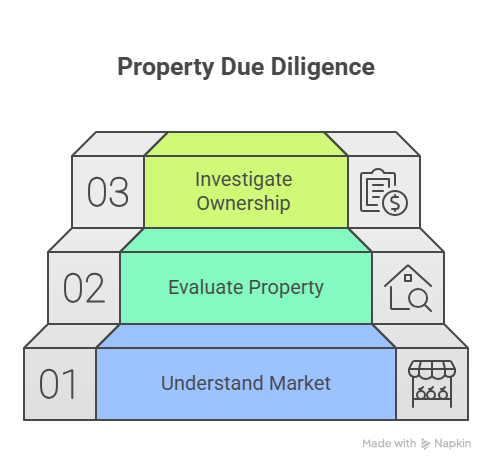

Assuming that the sponsor has passed your review [1] and the property meets your investment criteria [2,3], you have reached the final steps in your due diligence journey. The opportunity looks promising. The sponsor may be encouraging you to commit quickly. You may feel excitement about the projected returns. This is precisely when you must…

-

#76 Beyond the Sponsor: Analyzing the Property That Will Generate Your Passive Income

—

by

You have identified sponsors you trust [1] and refined your investment thesis to filter opportunities that align with your goals [2]. Now comes a critical juncture: evaluating the specific property that will house your capital for the next five to seven years. While your sponsor vetting process has eliminated the majority of deals crossing your…

-

#75 Book Review – Who Not How

—

by

Why the most successful investors ask “Who?” instead of “How?” When most of us encounter a problem or set a goal, our first instinct is to ask: “How can I accomplish this?” According to Dan Sullivan and Benjamin Hardy in their book “Who Not How” [1] this question, while natural, fundamentally limits our potential for…

-

#74 Different Types of Syndication Deals

—

by

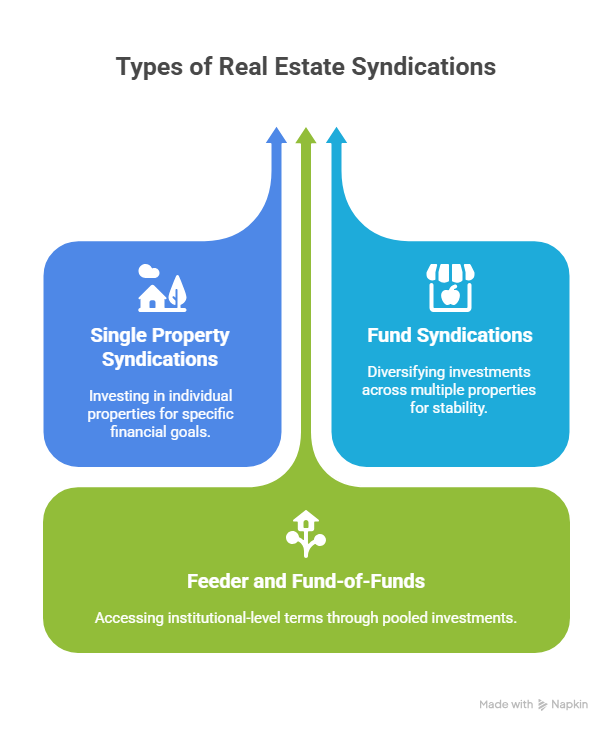

Investors entering the syndication space often assume all deals follow the same basic structure: a group pools money to buy a single, identified property. While this represents the most common opportunity you will encounter, limiting yourself to this single approach can restrict your ability to build truly diversified passive income streams. Understanding the three distinct…

-

#73 Understanding the Capital Stack and How It Impacts Your Returns

—

by

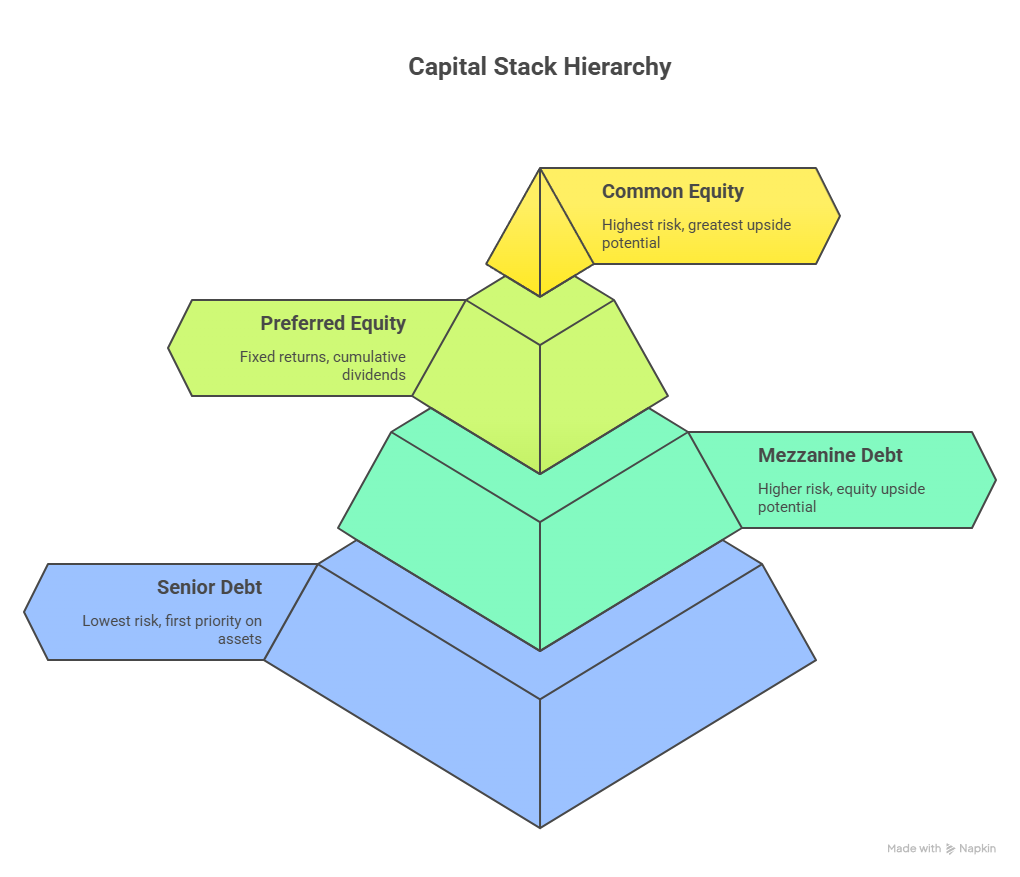

When evaluating real estate investment opportunities, most investors focus primarily on location, asset class, and projected returns. While these factors are undeniably important, there is another critical element that can dramatically impact your investment outcomes: the capital stack. Understanding how a deal is financed and structured can mean the difference between achieving your expected returns…

-

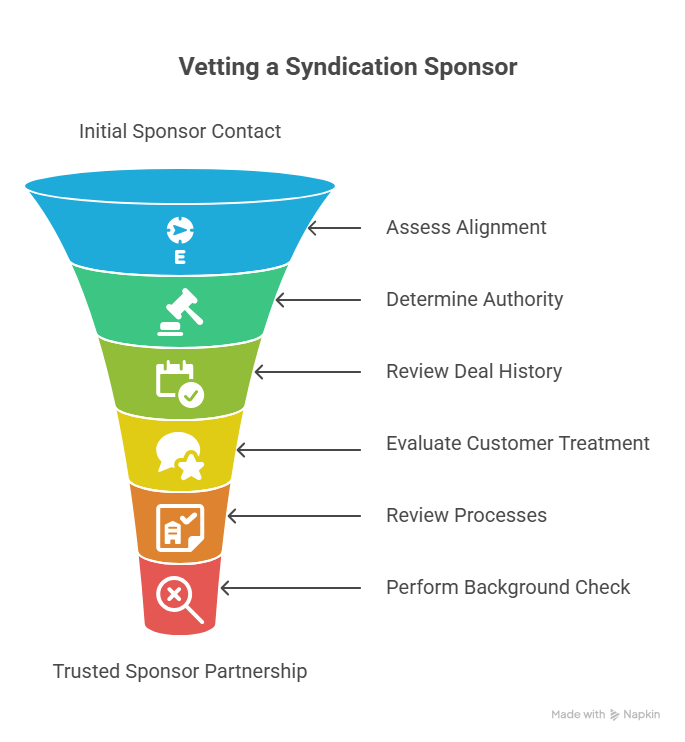

#72 Vetting a Syndication Sponsor

—

by

The most critical due diligence step for any passive investor involves thoroughly vetting the sponsor and team who will manage your investment. This principle cannot be overstated: an exceptional sponsor can transform a mediocre deal into a profitable venture, while an incompetent sponsor can destroy even the most promising opportunity. Your success depends entirely on…

-

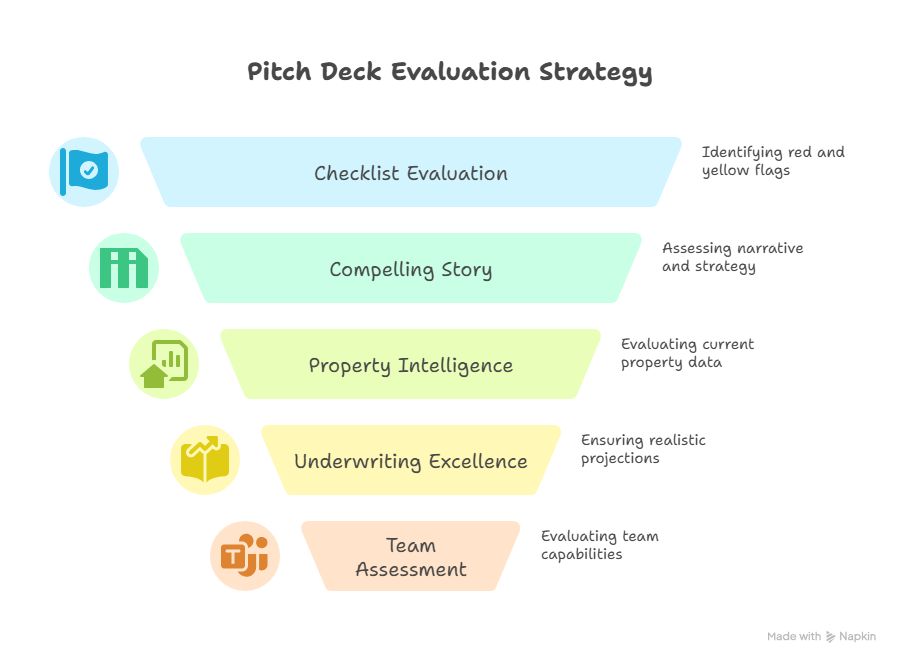

#71 How I Eliminate Deals That Don’t Work in Minutes

—

by

As your syndication portfolio grows, you will face a new challenge: too many opportunities and not enough time to evaluate them all. This abundance of options represents a significant shift in your investment journey. Where you once searched desperately for any deal, you now must become selective, strategic, and efficient in your evaluation process. The…

-

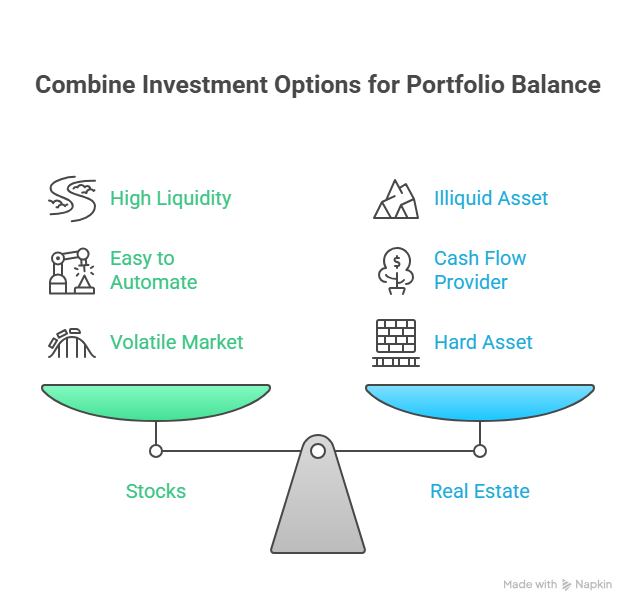

#70 Balancing Stocks and Real Estate in Your Portfolio

—

by

If you spend time in real estate investing circles, you will encounter a curious phenomenon: many seasoned real estate investors entirely dismiss stock market investing. Syndicators, in particular, seem to share a universal set of complaints about traditional securities:: These criticisms contain elements of truth, but they present an incomplete picture while ignoring the compelling…

-

#69 My Take on Gold and Silver

—

by

Gold has captured headlines again, soaring past $3,200 per ounce and touching $3,500 in April—a dramatic climb from under $2,400 just one year ago and under $2,000 two years back. While the financial media buzzes with predictions of continued growth, it is important to filter out the noise and intentionally decide what role precious metals…

-

#68 The Abundance Approach to Tax Strategy

—

by

For high-income professionals, taxes represent one of your largest annual expenses—yet most assume nothing can be done to reduce this burden. This assumption can cost of thousands of dollars each year, money that could be accelerating your journey toward financial independence through strategic investments. The reality is that intelligent tax optimization can save you $20,000…

-

#67 Automating Your Path to Financial Freedom

—

by

Not everyone enjoys dedicating substantial time to thinking about investing. This is perfectly understandable. Your professional responsibilities, family obligations, and everyday necessities create constant demands on your limited time and mental energy. When precious free moments arise, you want to relax and enjoy them—not analyze financial documents, evaluate investment opportunities, or study investment principles. The…

-

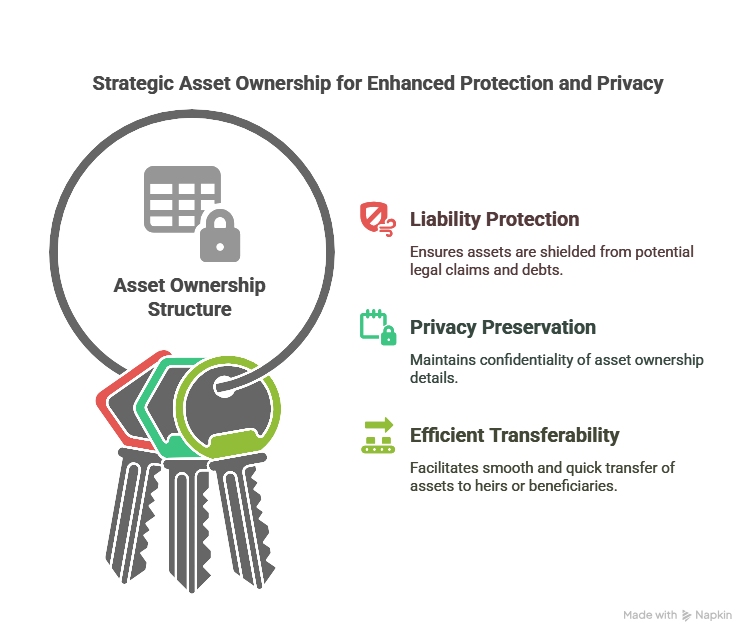

#66 Strategic Asset Ownership: Protecting What You Build

—

by

When you purchase an asset, one of the most fundamental decisions you face is how to hold that asset—determining who will be the owner of record. This decision might seem trivial early in your investing journey when you simply hold everything in your name. As your portfolio grows, however, the structure of ownership becomes increasingly…

-

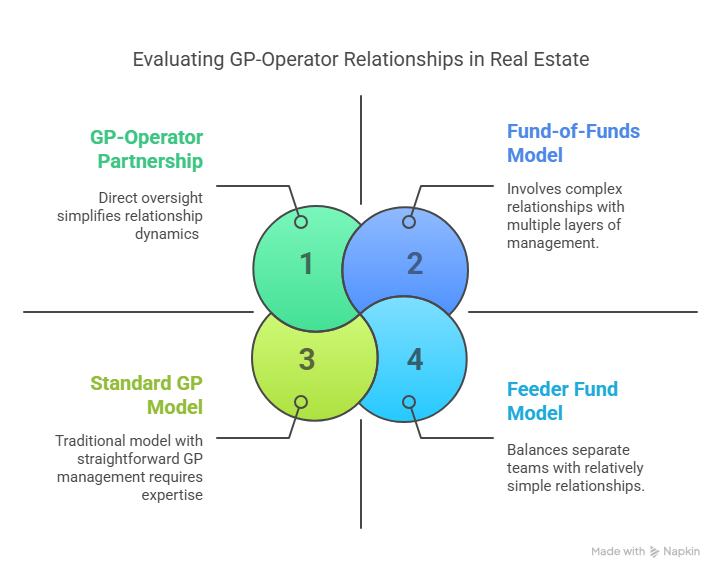

#65 Understanding GP-Operator Relationships: Critical Due Diligence

—

by

When conducting due diligence on a real estate investment opportunity, looking solely at the General Partner (GP) team provides an incomplete picture. Understanding who operates the property and the relationship between your GP and these operators is equally critical. This relationship can significantly impact your investment outcomes, yet it often remains overlooked by inexperienced investors.…

-

#64 Book Review – Tiny Habits

—

by

When building wealth while maintaining your professional career, your most valuable resource is not capital—it is your time, including the habits you fill your day with. B.J. Fogg’s “Tiny Habits: The Small Changes That Change Everything” [1] offers a refreshingly practical approach to behavior change. As a Stanford researcher who has studied behavior for decades,…