When conducting due diligence on a real estate investment opportunity, looking solely at the General Partner (GP) team provides an incomplete picture. Understanding who operates the property and the relationship between your GP and these operators is equally critical. This relationship can significantly impact your investment outcomes, yet it often remains overlooked by inexperienced investors.

In the simplest scenario, the GP team operates the deal directly. Your standard GP due diligence, which should include assessment of their operational expertise, would suffice in such cases. However, many real estate investment opportunities involve separate GP and Operator teams—a nuance that may or may not be clearly highlighted in marketing materials.

The complexity of these relationships matters profoundly. In my investment career, I have narrowly avoided two fraudulent deals where a common factor was the separation between GP and Operator teams. Whether the GPs were innocent or complicit, the outcome remained the same—investors lost their entire investment. This does not mean you should avoid deals with separate GP and Operator teams. In fact, these arrangements can be highly effective by allowing GPs to collaborate with specialized, best-in-class operators. However, understanding the exact nature of this relationship becomes essential to protecting your capital.

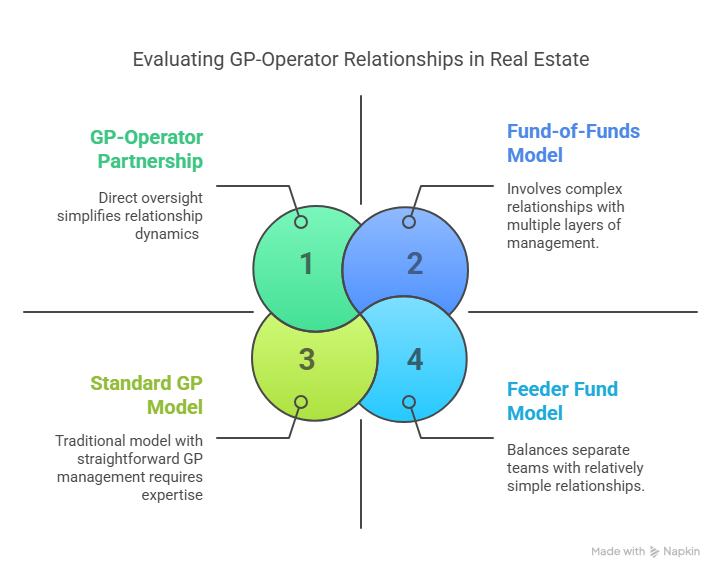

Three GP-Operator Scenarios

The Fund-of-Funds Model

In this approach, your GP invests in multiple deals, ideally being run by multiple Operators. This provides you a broader set of investments than you would be able to achieve on your own. Because your GP is writing a bigger check than you are, they tend to get preferential terms as well, which can offset their management fee. The downside is that your GP likely has no control over the individual deals within their fund. They are an LP in the other deals, and thus, like you, they do not make any of the decisions.

This is where it is important to understand your GP’s due diligence process. How they decide which operators to invest with becomes critical as you are relying on their process to weed out any bad actors. If they are good at it, this can save you a tremendous amount of work. Larger GP teams may have access to background check capabilities that you as an individual would not. If it is effective, leveraging your GPs due diligence process is a significant benefit of this model. However, if the process is minimal, then you are taking on additional risk. A good GP will be able to explain their process in as much detail as you want, and their explanation should include whether they invest with Operators who don’t manage the properties directly or not and, if they do, how they vet those managers as well.

The Feeder-Fund Model

Similar to the “fund of funds” model, your GP is an investor in the Operator’s deal. That means that the GP has no control over the deal and is unable to influence the decisions being made. Unlike that model, however, you are typically investing in a single deal with the Operator and do not get additional diversification. In these cases, the only benefits that your GP provides are the due diligence that they perform and the relationship that they have with the operator. Some GPs take their due diligence process seriously and will dive deep into the Operator’s process, including reviewing actual financials and performing site visits. Others, unfortunately, will trust the relationship that they have and not perform much due diligence beyond that.

The GP-Operator Partnership

The deal is owned by the GP who partners with the operator, who acts as the manager and handling all of the day to day interactions. This can provide you access to best-in-class operators and address potential shortcomings in the GPs experience with the asset class. In this case, it is important that you understand the relationship between the GP and the Operator and, in particular, the level of oversight that the GP will be providing. A GP who blindly trusts the operator can be easily taken advantage of in a number of ways. You want someone who will be actively managing the operator, verifying the financial records, and making sure that everything is being done properly and with the investor’s best interest in mind. The GP should have the ability to replace the Operator if things aren’t working as planned and they should have a list of replacement operators already identified.

Before You Invest

Unfortunately, it isn’t always clear if your investment falls into one of these scenarios. I have seen deals where that information is explicitly shared with investors, and others where that information is hidden deep within the PPMs. Regardless, understanding the exact role your GP plays in managing the investment is critical for risk assessment. You don’t want to discover when the deal is not going as planned that the person you thought was in control (your GP) is either unaware of the details or unable to influence the project.

Even worse, you don’t want the operator running a ponzi scheme while the GP is unaware of what is going on. While this may sound improbable, the two fraudulent deals that I have had a “close call” with share the model of a GP raising money for an Operator who was committing fraud. I don’t know whether the GPs knew about it or not, but at best it is clear that their due diligence process was insufficient.

On the plus side, I have invested in fund-of-fund deals where I get the benefits of a detailed GP due diligence process that includes ongoing monitoring of the operators – including requesting audited financials on a regular basis.

Key Questions to Ask Before Investing

Before committing capital to any real estate opportunity, ask your GP the following questions:

- Are you directly operating this investment, or working with a separate Operator?

- If working with an Operator, what is your specific relationship with them?

- What control mechanisms do you have if the Operator underperforms?

- How do you monitor the Operator’s activities and financial reporting?

- What due diligence have you conducted on the Operator, and can you share those findings?

- Have you worked with this Operator before, and what was your experience?

The answers to these questions will reveal much about both the investment structure and the GP’s approach to investor protection. Remember, thorough due diligence on both the GP and Operator relationship is not just prudent—it is essential for preserving and growing your investment capital.

For additional reading:

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.