Recent Newsletter Articles

-

#64 Book Review – Tiny Habits

—

by

When building wealth while maintaining your professional career, your most valuable resource is not capital—it is your time, including the habits you fill your day with. B.J. Fogg’s “Tiny Habits: The Small Changes That Change Everything” [1] offers a refreshingly practical approach to behavior change. As a Stanford researcher who has studied behavior for decades,…

-

#63 Establishing Your Investment Thesis – Part 3: Determine Your Tactics

—

by

Now that you’ve established your goals and overall investment strategy, it’s time to translate them into actionable tactics. This chapter will guide you through creating your investment thesis—a personalized framework that will serve as your financial compass for years to come. In particular, you need to establish your ideal: Design Your Portfolio Allocation The fundamental…

-

#62 Establishing Your Investment Thesis – Part 2: Clarify Your Strategy

—

by

“The most important investment you can make is in yourself.” — Warren Buffett Once you understand the goals for your investments [1] it is time to clarify your overall investment strategy. Building on the work of my mentors [2], I have identified five dimensions that combine to form the space of possible investments. Consider these…

-

#61 Establishing Your Investment Thesis – Part 1: Define Your Goal

—

by

While having a full-time job with a substantial paycheck is great, you are still trading your time for money. In order to break your paycheck dependency, you need to develop a strategy that puts your hard earned income to work for you. This article provides the first step in developing your personal investment thesis. At…

-

#60 Yield on Cost vs Cash-on-Cash and IRR

—

by

You’re likely familiar with the challenge of evaluating investment opportunities. With sponsors presenting different metrics to showcase their deals, it’s crucial to understand which numbers truly matter for your investment decisions. Recently, Yield on Cost (YoC) has gained popularity, with some sponsors even suggesting it should be the primary metric for evaluating deals. But is…

-

#59 Book Review: Finish: Give Yourself the Gift of Done

—

by

Most of us have a pile of half-finished projects and abandoned goals. With this being the season where most new resolutions are added to that pile, I wanted to share a book that helps you stay on track and accomplish your goals. In his groundbreaking book “Finish: Give Yourself the Gift of Done,” Jon Acuff…

-

#58 Two Unfortunate Trends in Sponsor Communication

—

by

As passive real estate investors, we often focus on the numbers – IRR, equity multiples, and cash-on-cash returns. But I’ve discovered that a sponsor’s communication patterns can tell you more about their operational excellence and investment philosophy than any pro forma. Recently, I’ve observed two concerning trends in sponsor communications that every Limited Partner should…

-

#57 Note Investing 101

—

by

One of my favorite asset classes for cash flow is notes – also known as mortgages, hard money loans, or private money loans. Think of it as becoming the bank – without the bureaucracy. There are two common ways to invest in notes. The first is to invest directly in a specific note against a…

-

Breaking the “Never Sell” Myth

—

by

You’ve heard the conventional wisdom – “never sell your real estate investment” – but is that always the right move? Spoiler alert: It’s not. Absolutes are rarely your friend. As with any professional activity, real estate investing requires continuous optimization, strategic thinking, and a willingness to evolve your strategy. As an investor, you need to…

-

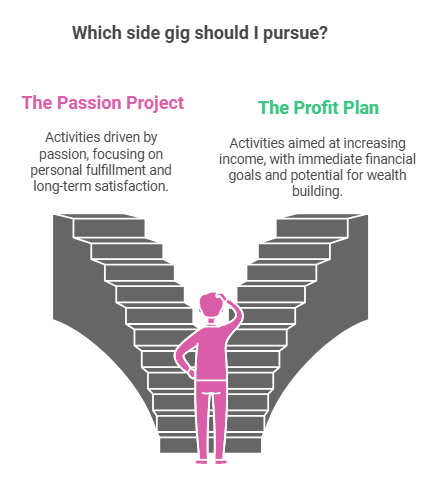

Side-Gigs: Passion Project, Profit Generator, or Both

—

by

For many successful tech professionals, the idea of starting a side gig can be both appealing and confusing. While your day job provides a comfortable income, you might find yourself drawn to additional ventures – whether for passion, profit, or both. However, before diving in, it’s crucial to understand what truly drives this desire. From…

-

Consistent strategy, evolving tactics

—

by

There is a fundamental difference between your overall strategy – the long term vision of what you want to do – and the tactics that you use to make progress on that strategy. My strategic vision has been to I use my personal investment philosophy [1] as the framework within which I take action. The…

-

Book Review: The Lifestyle Investor

—

by

I recently re-read The Lifestyle Investor by Justin Donald [1]. While a new version of the book came out n April, I read my copy of the original.

-

How compounding supercharges your net worth

—

by

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it,” is a quote attributed to Albert Einstein. Whether he actually said it or not is unclear [1].

-

Your retirement number changes based on your investment strategy

—

by

Imagine reaching the point in life where your investments generate enough income to cover your expenses, freeing you from the constraints of a traditional job.

-

The benefit of separating accounts for financial goals

—

by

I was talking to a friend of mine about investing in cash flowing real estate a couple of weeks ago, and the conversation really made me think about things that I take for granted.

-

The Invest 4 an Abundant Life Book Club: Building a community around books

—

by

If you’re a seasoned investor, you know the power of continuous learning. Books offer an invaluable resource to expand your knowledge, gain new perspectives, and stay ahead of market trends.

-

Book Review: Legal Strategies for Everyone

—

by

As a high net worth individual, which accredited investors are by definition, the unfortunate reality is that you become a target for lawsuits. Whether or not the lawsuit is justified is totally irrelevant, they occur and expensive judgments can be awarded. Most people don’t think about that until it is too late to do anything…

-

Customer service lessons from the latest travel meltdown

—

by

Starting 7/19/24 and continuing through at least 7/25/24, there has been a major disruption in the airline industry as the result of a software update gone bad [1]. There are many lessons that will be (re-)learnt from this on the software engineering side, with some airlines recovering quickly and others struggling to get back to…

-

Our Pre-offer Due Diligence Process (part 2/3)

—

by

Have you ever wondered what we look at before we make an offer on a potential property? Before diving in, it’s crucial to uncover a facility’s true potential but that can be a daunting process. In our previous article [1], we gave a high level overview of what we look at. This week, we’re cracking…

-

Book Review: Buy Back Your Time

—

by

One of the main reasons to break your dependency on your paycheck is to stop trading your time for money and instead focus on the things that are most important to you and bring the most value to you, your family, and, more broadly, the world in general.

-

Deep dive on our values: Community

—

by

MBC Real Estate Investing is built on 4 core values: abundance, freedom, community, and reliability [1]. I want to go a little deeper into what these values mean to us, so that you have a better idea of whether or not our views align with yours. I believe that understand someone’s values is important to…

-

Deep dive on our values: Abundance

—

by

MBC Real Estate Investing is built on 4 core values: abundance, freedom, community, and reliability [1]. I want to go a little deeper into what these values mean to us, so that you have a better idea of whether or not our views align with yours. I believe that understand someone’s values is important to…

-

How do you know who to take advice from?

—

by

A question I got recently from another syndicator is “Who do you go to for unbiased retirement investing advice?”

-

Book Review – 10x is easier than 2x

—

by

Grant Cardone made thinking 10x bigger popular with his book “The 10x Rule” [1] back in 2011. However, he focused on the mindset that you need to reach these seemingly impossible goals. Building on this idea, and providing some additional insight into how to actually make this work, Dan Sullivan and Benjamin Hardy published “10x…

-

Book Review – Getting Things Done: The Art of Stress-Free Productivity

—

by

I am an avid reader of non-fiction. I believe in continuous education and find that books provide an incredible wealth of information. Reading a good book provides both inspiration and insight, opening the mind to new possibilities.

-

What is a cost segregation and why should I care if I am not a real estate professional?

—

by

If you hang around commercial real estate investors for any length of time, you will hear the term “cost segregation” come up.

-

Appreciation vs cash flow investing philosophies

—

by

There are at least two major investment philosophies. The first is to invest for appreciation the other is to invest for cash flow.

-

How I think about, and manage, risk in real estate investing

—

by

If you have been paying attention to the economy lately, you know there is a lot going on.

-

What do you mean, “my home is not an asset”?

—

by

If you have ever read the classic Rich Dad, Poor Dad [1] you have seen Robert Kiyosaki assert that your home is not an asset but rather a liability (note: if you haven’t read this book, you should, it is a classic and helps establish the mindset required to become financially independent). This is one…

-

What does “active investing” in real estate mean?

—

by

When people think about real estate investing, what they typically think about is active investing. In active investing you do the work to make the investment succeed. And if you don’t do the work, your investment will likely not be successful. This is what a sponsor does, but you don’t have to be leading a…

-

Thoughts on the latest bank failures

—

by

It has been a really interesting week on the financial front, so I wanted to take a break from my normal focus on syndications and talk about what has happened so far, what seems to be happening in the short term, and some possible long term implications. While this isn’t specifically focused on real estate…

-

Definition: What is an accredited investor?

—

by

An accredited investor is the term used by the SEC to refer to investors who are “financially sophisticated”. Accredited investors are able to invest in a wide variety of opportunities that normal investors are not – some of which (such as capital raises for tech startups) are much riskier than the investment options that are…

-

When should you use an IRA or other retirement accounts to invest in syndications

—

by

Standard disclaimer: I am not an accountant or financial advisor, and am not providing tax or financial advice, this article reflects my understanding of the rules as they currently exist and is not a recommendation on what you should do. I always recommend talking to your tax and financial advisors before making any financial decisions.

-

My advice for new investors

—

by

One of the questions I usually get when talking to someone who is looking at real estate investing for the first time is, “Where do I start?” Sometimes the question comes out as directly as that, sometimes the conversation dances around the topic for a while.

-

What I look for in a potential sponsor

—

by

I would argue the single most important decision you make about investing in syndications is not which deal to invest in, but which sponsors do you invest with. Obviously the deal itself is important – the numbers need to make sense and it needs to fit within your overall investment philosophy – however many investors…

-

Where to put your investing dollars: REI vs the stock market – High level (1/2)

—

by

These days, an investor looking for a fully passive return has a lot of options. One of the most common approaches is to put money into an index fund and let it grow. Then, when you need a stream of income, you can start drawing down the funds with the 4% rule giving you guidelines…

-

Who should consider investing in a syndication (An Introduction to Syndications Article 2/3)

—

by

I believe syndications are an amazing investment opportunity for a large number of people – including many people who don’t even know they exist. But there are some drawbacks that you need to be aware of as well and so they aren’t the right option for everyone. As with any investment you make, it is…