For many successful tech professionals, the idea of starting a side gig can be both appealing and confusing. While your day job provides a comfortable income, you might find yourself drawn to additional ventures – whether for passion, profit, or both. However, before diving in, it’s crucial to understand what truly drives this desire.

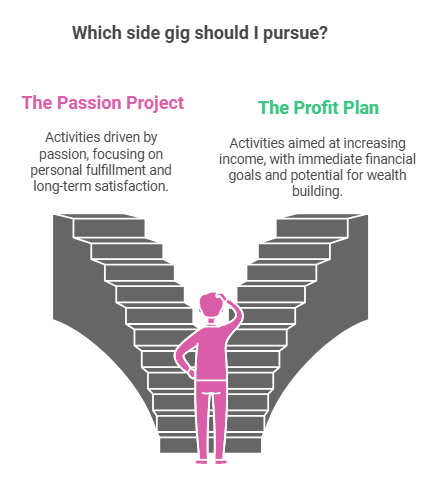

From what I have seen, “side-gig” represents two fundamentally different concepts:

- The Passion Project: Something that you do because you are passionate about it and you would do it whether or not you are making money – i.e. a hobby that at least pays for itself. Think of the artist that sells a couple of paintings per year at an art show. This may eventually lead to wealth, but that isn’t the goal. The goal is to do something that you love doing.

- The Profit Plan: Something that you do because you are specifically trying to make more money whether working for yourself or someone else – i.e. a second job with significant income potential. Think of someone driving for Uber or a contractor working on the weekends. The immediate goal here may be to pay down some bills or start building wealth, with a longer term goal of using the income to replace your day job.

Ideally, you would be doing something that meets both criteria – you really enjoy the work and you are able to make substantial money at it. In reality, however, that is usually not the case. There are always exceptions on both sides of course, but they are exceptions.

As a high-income professional, you have a unique advantage: your day job already covers your basic needs. This allows you to be more strategic about your side ventures. However, it also means you need to be especially clear about your motivations.

These days, everyone seems to be about pursuing your passion – with the, often explicit / sometimes implicit, assumption that money will inherently follow. While that advice isn’t completely wrong, it is definitely oversimplified. The world rarely rewards people just because they enjoy the work they are doing. I would argue that the vast majority of people do not make most of their money following their primary passion in life. They do something to pay the bills and then pursue their passion on the side.

Most importantly, don’t go into a side gig selected by (1) thinking that you are going to suddenly be able to replace your day job. Making a small amount of money on a hobby is relatively easy, but building a business is entirely different. You don’t want to create a job you hate because you aren’t clear on what you are trying to accomplish. Consider that if you want to focus on money generation, you may be better off doing more of what you already know how to do. For example, if you know how to code or develop websites, you may be better off freelancing as a developer than a photographer if the income stream is your main motivation.

In his book “The E Myth Revisited” [1], Michael Gerber highlights that one of the reasons businesses fail is that people assume that because they love to do something they can build a business around it – but they don’t have the skills to build the business itself. This revelation applies to side-gigs as well as to startups. Instead of building a business, if your focus is on pursuing your passion, staying small or working within someone else’s business – even as a freelancer / contractor – can increase your overall satisfaction and provide a steady stream of income without the risk (and potential upside) of building your own business.

I am fortunate that I enjoy real estate investing. I can spend hours happily looking at deals, studying markets, investigating different asset classes, etc. as I decide where to personally invest. I enjoy going to real estate events, learning new strategies and technologies, and talking with other investors. I listen to tax and real estate podcasts for fun. I also like to share how passive investing has changed my life and allowed me to retire early, so I write this blog and post on LinkedIn. Following my passion has gotten me to where I am – because I enjoy spending the time doing the work.

However, this approach will not make me a billionaire (or even a centi-millionaire :)), which could be a goal of someone pursuing real estate investing but being driven by profit. I have consciously decided that I am not willing to do the work required to build a business around this passion at this point in my life. I don’t get enjoyment out of managing other people, dealing with tenants, or doing construction. I don’t want the headaches of dealing with the day-to-day issues and having to constantly solve problems. If I was pursuing this for profit instead of as a passion, that would be where I would need to focus my energy to be successful.

Once you figure out your real motivation, answering the questions becomes easy. You know:

- What to do when you get stressed out.

- When to pivot and when to hold the course.

- Whether to focus on the money or building your expertise.

- Who you need to be learning from – entrepreneurs or experts.

- Why you are doing this, so you can push through the hard times

As with most things, I find that it is important to understand your motivations before making a decision. Once you understand why you are doing something, it becomes much easier to figure out the path.

Key takeaways:

- Leverage Your Position: Your high income provides the freedom to choose between passion and profit without immediate financial pressure.

- Think Strategically: Consider how your side gig fits into your overall wealth-building strategy, particularly regarding passive income generation.

- Maintain Balance: Choose a path that complements rather than compromises your career.

- Stay Flexible: Your interests and goals may evolve – what starts as a passion project might develop profit potential, or vice versa.

As my mentor Russ Gray wisely says “Once strategy is clear, tactics become obvious”.

For additional reading:

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.